By Brian Reyes, Senior Vice President of Higher Education

This academic year is looking quite a bit different from years past. Instead of publishing fall football and volleyball schedules, universities and colleges are publishing CDC guidelines for campus disinfection protocols in the face of COVID-19. And that’s for the institutions that are reopening in some capacity. Some are not reopening in person at all.

Since the onset of COVID-19, higher education leaders have been working through their return to school strategies—reopening fully in-person, fully online or in a hybrid capacity. With so much at stake, including the health and safety of the students, faculty and staff, this decision is a monumental one that needs to be carefully considered. The financial impact of this decision needs to be considered as well because whichever route the institution takes will ultimately have financial ramifications both in the short and long terms.

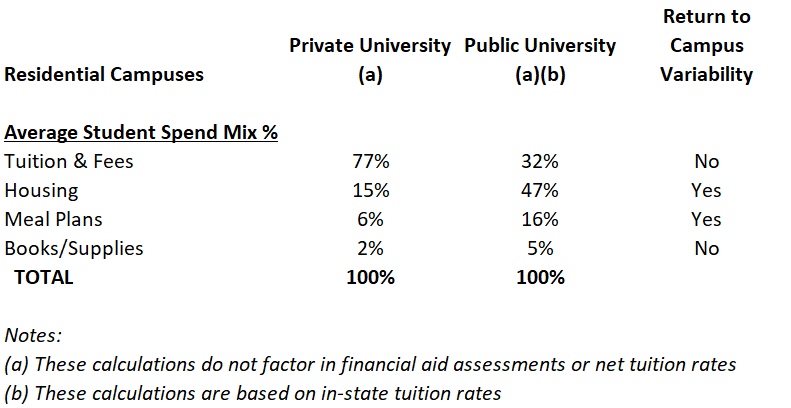

Before making any decisions, higher education leaders need to understand the numbers. The financial impact of campus re-openings can have a variety of outcomes based on several factors such as the average student spending mix for on-campus student residents; the normal student housing capacity pre-COVID-19; the percentage of students participating in residential student housing; and the percentage of total revenue budgeted to meet CDC guidelines for campus disinfection protocols. For reference, the table below represents the average student spending mix as a residential student under pre-COVID-19 conditions.

There are several key takeaways from this data:

- Of the four primary areas of spending, on-campus student housing and meal plans are highly dependent on housing capacity utilization.

- For residential students at public universities, over 60% of the spend is for housing and meal plans, which represents a majority of the total cost of attendance.

- For residential students at private universities, the percentage of spend for housing and meal plans averages just over 21%, far less impact on total cost of attendance versus public universities.

- Private universities’ greater reliance on tuition suggests they can be more vulnerable to enrollment declines, but it also gives them a stronger revenue lever to work with.

- Meal plans that are managed by outsourced food service providers typically offer universities a yield or commission from net sales, so meal plan declines impact university profitability.

- Housing operations represent a significant amount of fixed cost, so low or no occupancy creates a challenging financial burden.

For the following types of instruction, there should be an expectation of the following estimated financial impacts, which would be calibrated based on each campus’ individual situation. Even though these are approximations, they offer a good indication of the full financial impact each scenario would have on institutions.

Fully online instruction (essentially no on-campus participation)

- Up to 100% housing revenue decline

- Up to 100% meal plan revenue or yield/commission decline

- Up to 15% increase in costs related to non-academic and non-housing campus cleaning and disinfection for essential workers only to meet CDC guidance

Hybrid instruction (expectation for approximately 30% of housing capacity utilization or less):

- Up to 70% housing revenue decline plus adjustment for 2-3 fewer weeks of housing for campus closure after Thanksgiving break

- Up to 70% meal plan revenue or yield/commission decline

- Up to 60% increase in costs related to campus cleaning and disinfection to meet CDC guidance

All live instruction (potential for normal housing occupancy rates adjusted for any impact to enrollment levels due to lack of online capability):

- Up to 5% housing revenue decline to reserve occupancy for student isolation situations if they test positive for COVID-19

- Housing revenues to be adjusted for 2-3 weeks less occupancy assuming a campus closure after the Thanksgiving break

- Up to 60% increase in costs related to campus cleaning and disinfection to meet CDC guidance

The charts indicate that many colleges and university budgets will be more challenged than ever as a result of COVID-19. With so much up in the air, higher ed leaders are looking to non-traditional revenue to keep their institutions solvent.

It’s important to understand the value of different asset types—and what the options are. Different asset types serve different purposes and can be creatively repurposed to bring in revenue. Athletic venues, for example, can be transformed into a mixed-use development, creating additional revenue streams. In addition to knowing the assets’ value, they need to be safely reopened. From on-campus student housing to the life sciences buildings to the performing arts building on campus, there’s so much to consider when reopening safely. This interactive map provides a road-map outlining the various value considerations of different campus asset types—while also providing paths to reopen.

As higher ed leaders consider strategies and protocols for Fall 2020 instruction, they will be challenged to balance the short-term cost implications of various return-to-campus scenarios with the long-term implications to institutional brand and enrollment metrics. There are important elements of costs to consider under each scenario and those captured here can provide a framework to assist decision-makers in that process.

In my conversations with campus officials across North America, what continually comes through is doing the right thing—remaining focused on providing high-quality education, designing engaging learning experiences in various formats, and providing physical safety and mental well being for students, faculty and staff.

As a parent of a university student myself, I too am concerned with these items and share in the level of concern on the financial and health impacts to both institutions and the students enrolled in these schools.

No matter which scenario colleges and universities ultimately choose, playing the long game by doing the right thing and protecting the institution’s brand during this time is key. You may have to evaluate new solutions to assist in creating a financial bridge toward long-term success, but future recruiting efforts can be impacted positively or negatively as new generations of students ponder their future education.

This article originally appeared in University Business. You can find it here.